Cross-Exchange Funding Arbitrage

7/18/2025

How to Profit from Market Inefficiencies

While most traders focus on price, smart traders focus on inefficiencies.

Cross-exchange funding arbitrage is one of the cleanest ways to extract yield from crypto markets — without taking high price risk.

In this post, we’ll break down how it works, what makes it possible, and how to start spotting opportunities in real time using Smartbitrage.

What Is Cross-Exchange Funding Arbitrage?

This strategy takes advantage of differences in funding rates for the same asset across multiple exchanges.

It works like this:

- You open a long position on Exchange A.

- At the same time, you open a short position of the same size on Exchange B.

- You hold both positions delta-neutral, capturing the positive funding spread between them.

You’re not betting on price — you’re betting on rate divergence.

A Real-World Example: Cross-Exchange Funding Arbitrage

Let’s say the funding rates on two exchanges for BTC perpetual futures are:

- Exchange A: longs pay 0.03% every 8 hours

- Exchange B: shorts pay 0.01% every 8 hours

If you take opposite positions:

- Go short on Exchange A (you receive 0.03% funding every 8 hours)

- Go long on Exchange B (you receive 0.01% funding every 8 hours)

This means you:

- Earn 0.03% from your short position on Exchange A

- Earn 0.01% from your long position on Exchange B

- Net 0.04% every 8 hours, with very little market risk since the positions hedge each other

Over time, these funding payments add up, providing a steady stream of income. This income can be significantly boosted by using leverage, allowing you to scale your positions and amplify returns.

The key is keeping your positions balanced and carefully monitoring fees and sudden changes in funding rates to avoid unexpected losses.

This strategy takes advantage of small inefficiencies between exchanges to earn a low-risk yield.

What Makes It Work?

Several structural factors create these inefficiencies:

- Different user sentiment across platforms

- Variations in funding mechanisms (intervals, caps, oracle methods)

- Latency in price discovery, especially between DEXs and CEXs

- Market-specific events driving local imbalances

This creates funding deltas that you can exploit — if you’re fast and systematic.

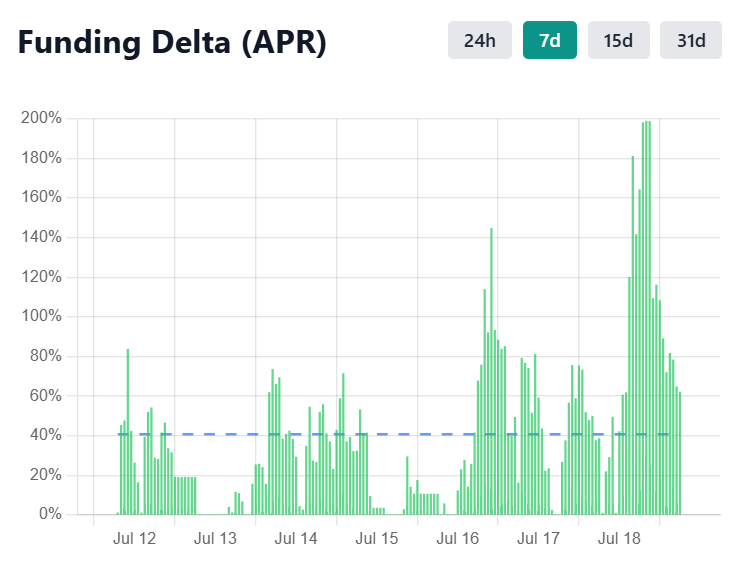

This is a real example of an opportunity captured with our tool, showing that over the last 7 days there was a funding delta between the exchanges Backpack and Hyperliquid on $ENA that would have allowed us to achieve approximately a 40% APR using this strategy (at the time the screenshot was taken).

Key Risks of Funding Rate Arbitrage

Even if the strategy is delta-neutral in theory, you should be aware of:

- Execution lag: One side fills before the other, exposing you to price swings

- Fees: Trading, funding, withdrawal — these can silently erode profits

- Leverage mismatches: One exchange may liquidate faster than the other

- Liquidity traps: Illiquid markets may prevent proper sizing or exiting

Smart arbitrage is all about precision and timing.

How Smartbitrage Helps

With Smartbitrage, you don’t need to manually check each exchange.

We scan real-time funding rates across major platforms — and highlight:

- Where the biggest spreads are right now

- Which assets show historical arbitrage patterns

- Which strategies would have been most profitable over the past weeks

You get the signal, not the noise — and can act before the window closes.

What’s Next?

This is just the beginning, crypto markets are full of inefficiencies — and the smartest traders are the ones who learn to spot them early.

Whether you’re a casual observer or a seasoned arb trader, funding rate discrepancies offer a powerful opportunity to generate yield with limited risk — if you act fast.